Grants and funding

Financial assistance to Farmers, Schools, and Industrial businesses for infrastructure projects

Woolworths Dairy Innovation Fund

The Fund will deliver $5 million in grants up to $100,000 each over three years to Australian dairy farmers in our supply chain. These grants will support on-farm improvements that deliver innovation, efficiency, greater resilience, or enhanced sustainability.

Funding provided by Woolworths under a Grant may only be used by the recipient in connection with:

- the purchase or development of plant, equipment and/or infrastructure to be used in connection with dairy farming; or

- dairy farming research and development activities.

Examples of suitable purposes include (but are not limited to) investment in:

- water infrastructure (eg. improvements to irrigation, storage, bores, troughs, shed hygiene and recycling);

- fodder infrastructure (eg. storage, machinery, fodder mixers);

- initiatives that improve on-farm sustainability, including ag-tech solutions and initiatives that improve animal health, welfare and milk quality; and

- IT upgrades and training.

Australian dairy farmers who contribute milk to Woolworths’ dairy supply chain are invited to apply by downloading and filling out the application form below. Once filled out, please send your application form along with any supporting documents and images to [email protected]

Download application form here

The third round of the Woolworths Dairy Innovation Fund will open later this year.

Full information available at the LINK.

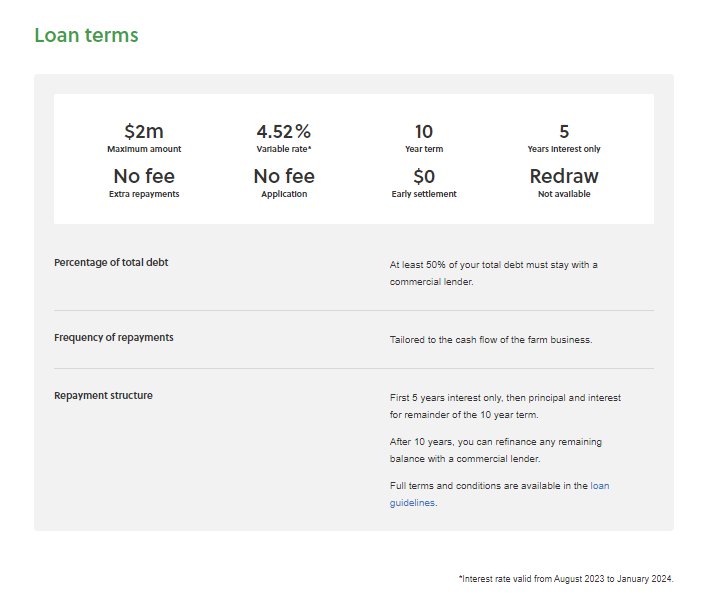

Farm Innovation Fund NSW

The NSW Government has committed $1 billion to the Farm Innovation Fund.

NSW farmers can borrow up to a maximum of $1 million per project, with a total of $1 million outstanding at any one time to build on-farm infrastructure, including stock containment areas.

The Farm Innovation Fund is a long term, low interest rate loan scheme for NSW farmers for permanent on-farm infrastructure. The Farm Innovation Fund helps farmers to:

- improve farm productivity – reduce risks and improve efficiencies by building fodder and grain storage facilities, sheds, fencing, roadworks and solar power conversions.

- manage adverse seasonal conditions – improve water efficiencies with irrigation systems, cap and piping of bores, new dams, install water tanks and desilting of ground tanks.

- ensure long term sustainability – increase the viability of a farm business and improve pasture and soil health, plant trees for shade and wildlife corridors, eradicate weeds, flood proof property and fence riverbanks.

Funds approved as of October 15, 2023:

Farm Innovation Funds approved – $720,199,059

Seafood Innovation Funds approved – $12,967,095

Drought Assistance Funds approved – $141,821,979

Remaining funding – $125,011,867

We recommend using Google Chrome browser to complete all online forms.

Full information available at the LINK.

AgriStarter Loan

There are two kinds of AgriStarter loans – first farmer loans and succession loans.

You can apply for a first farmer loan if you are seeking to purchase, establish or develop a farm business in which you hold or will hold the sole interest or a controlling interest.

You can apply for a succession loan if your farm business is undertaking or has undertaken succession planning.

Refer to the AgriStarter Loan Guidelines for further eligibility requirements.

An applicant must meet all eligibility criteria outlined in the AgriStarter Loan Guidelines before they can obtain an AgriStarter Loan.

Apply for an AgriStarter Loan online

Quick facts

Farm Investment Loan

Loans to make your farm business stronger, more resilient and more profitable.

Use this loan to

- refinance your debt

- enhance your productivity

- pay for operating expenses or capital

- fund drought-related activities

Quick facts

Full information available at the LINK.

Instant asset write-off for eligible businesses

Eligible businesses can claim an immediate deduction for the business portion of the cost of an asset in the year the asset is first used or installed ready for use.

Instant asset write-off can be used for:

- multiple assets, if the cost of each individual asset is less than the relevant threshold

- new and second-hand assets

Eligibility to use instant asset write-off on an asset depends on:

- your aggregated turnover (the total ordinary income of your business and that of any associated businesses)

- the date you purchased the asset

- when it was first used or installed ready for use

- the cost of the asset being less than the threshold.

You are not eligible to use instant asset write-off on an asset if your aggregated turnover is $500 million or more.

If temporary full expensing applies to the asset, you do not apply instant asset write-off.

If you are a small business, you need to apply the simplified depreciation rules to claim the instant asset write-off. It cannot be used for assets that are excluded from those rules.

The instant asset write-off does not apply for assets you start to hold, and first use (or have installed ready for use) for a taxable purpose, from 7:30pm (AEDT) on 6 October 2020 to 30 June 2023. You must immediately deduct the business portion of the asset’s cost under temporary full expensing.

Full information available at the LINK.

Accelerated Depreciation for Primary Producers

If you are a primary producer, you may be entitled to claim an immediate deduction for capital expenses incurred on fencing and fodder storage assets.

Typical fodder storage assets include:

- silos

- liquid feed supplement storage tanks

- bins for storing dried grain

- hay sheds

- grain storage sheds

- above-ground bunkers

More information available at the LINK.

Capital grants for non-government schools

Non-government schools may be able to get Australian Government funding to improve school infrastructure through the Capital Grants Program. Some of these schools received funds for Covered Outdoor Learning Areas (COLA) in schools.

Program Guidelines can be accessed at the LINK.

Programs for the Development of Educational Facilities

The capital grants programs of the Australian and Queensland Governments assist eligible independent schools to plan, construct, convert, refurbish, and upgrade educational facilities, boarding facilities and distance education facilities. There are two programs which Approved Authorities and their schools may access, when seeking assistance for projects regarding educational facilities.

Find out about the eligibility criteria for both CGP and SCAS, the program guidelines, support documentation and resources for the application process here:

Applications under the 3rd round of GCP and SCAS are currently open.

Full information available at the LINK.

Disaster relief loans – Primary producers

Primary producers directly affected by a declared natural disaster who are in urgent and genuine need of assistance, may be eligible for low interest loans of up to $130,000.

- Loan term Up to 12 years, first two years are interest and repayment free

- Interest rate – 0.80%

See Guidelines

Applications for these programs under the February 2022 event are now open until 30 June 2023 and approved applicants now have until 30 September 2023 to lodge invoices to claim payment.

Full information available at the LINK.

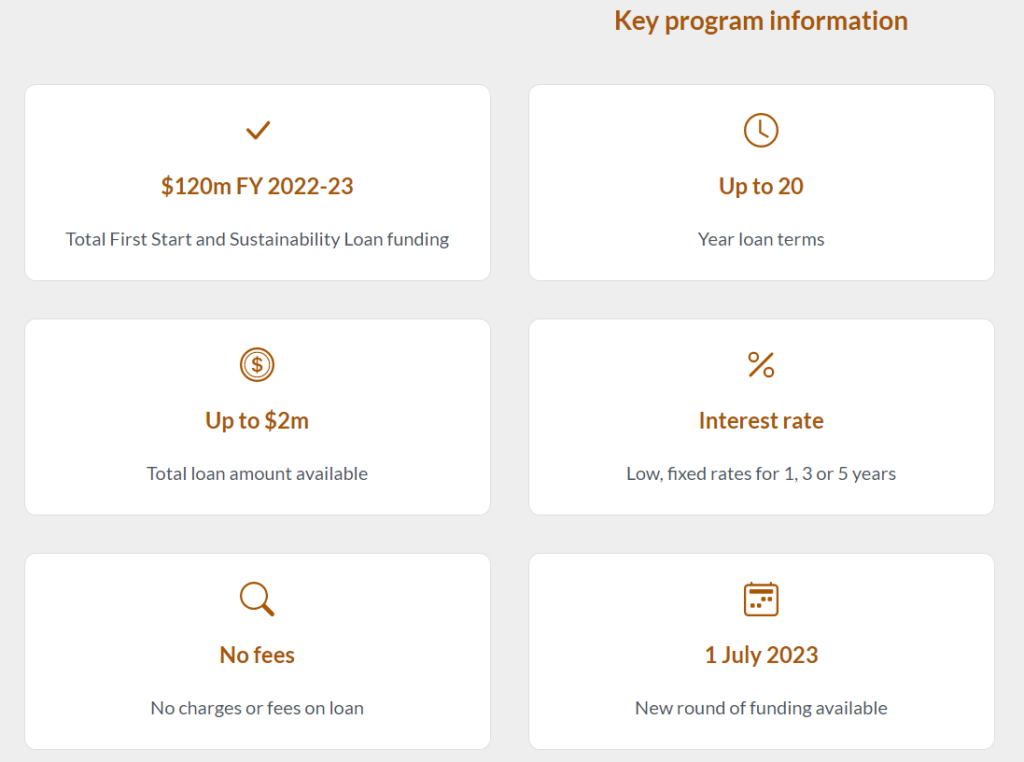

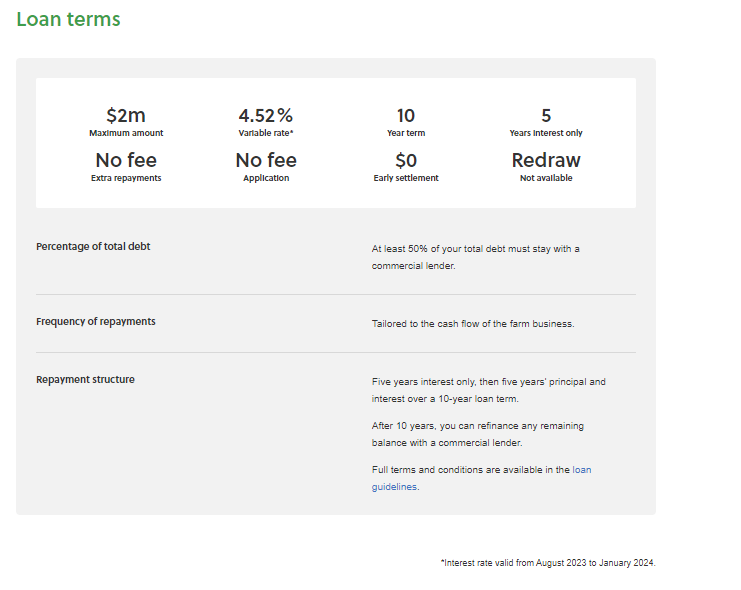

Queensland Rural and Industry Development Authority – First Start Loan

A First Start Loan can provide you with concessional finance of up to $2 million to assist you in the initial years of establishing your Queensland based primary production business.

Full information available at the LINK.

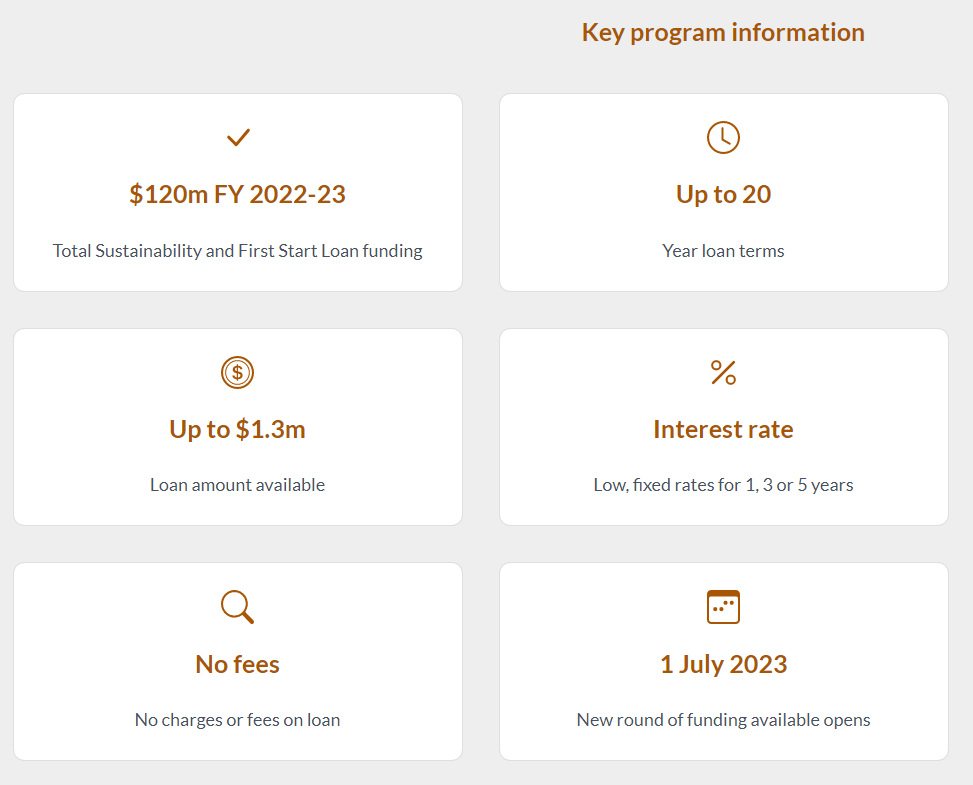

Queensland Rural and Industry Development Authority – Sustainability Loan

A Sustainability Loan can help you secure the future sustainability of your existing Queensland based primary production business.

More information available at the LINK.

Northern Australia Infrastructure Facility (NAIF) funding

The Northern Australia Infrastructure Facility (NAIF) is a $5 billion lending facility to provide loans to infrastructure projects in northern Australia. NAIF can provide debt or equity finance to projects that satisfy the relevant mandatory criteria in its Investment Mandate. The mandatory criteria require that each project must:

- Involve the development or enhancement of infrastructure.

- Be of public benefit.

- Be in, or have significant benefit for, northern Australia.

- For debt finance, be able to repay or refinance NAIF’s debt.

- Have an Indigenous engagement strategy.

- For equity investments, generate a return to Government.

The projects that NAIF can finance are wide ranging and include physical structures, assets, technology or facilities that contribute to the establishment or enhancement of economic activity in a region.

Examples of the sectors that NAIF can support include, but are not limited to, resources, airports, ports and rail, agriculture, water, energy, social infrastructure (including property, tourism, education and health), manufacturing and telecommunications.

Full information available at the LINK.

Net Zero or climate change grants

Emissions Reduction Fund

The Emissions Reduction Fund provides businesses with the opportunity to earn Australian carbon credit units for every ton of carbon dioxide equivalent a business store or avoids emitting through adopting new practices and technologies.

The Emissions Reduction Fund (ERF) incentivizes Australian businesses to cut the amount of greenhouse gases they create and to undertake activities that store carbon.

This can be through projects involving:

- new technology

- upgrading equipment

- changing business practices to improve productivity or energy use

- changing the way vegetation is managed to store more carbon.

The applications may be made at any time.

More information available at the LINK.

Emissions reduction incentives

We encourage businesses, industries and consumers to reduce their emissions through a number of programs and initiatives.

- The Emissions Reduction Fund (ERF) aims to provide incentives for a range of organisations and individuals to adopt new practices and technologies to reduce their emissions and store carbon.

- Climate Active encourages Australian businesses to become carbon neutral by awarding Climate Active Carbon Neutral Standard certification. Read how we administer Climate Active.

- The government is developing a new Safeguard Crediting Mechanism to incentivise industry to further reduce emissions. This is in line with recommendations in the King Review.

- The Renewable Energy Target (RET) scheme reduces emissions by encouraging more electricity generation from renewable sources.

Information how to APPLY.

More information available at the LINK.

Community Zero Emissions Grants

The Community Zero Emissions Grants Program is available to help fund projects that lower emissions. The total grant amount available is $600,000 over four years, ending in 2025.

Applications for the current round of funding have closed.

Successful grant recipients will be announced before June 2022.

More information on the current and future rounds will be available at the LINK.

CEFC Agribusiness support

The CEFC is an active financier to agribusiness, and we’ve worked closely with the sector to identify where clean energy technologies can have substantial benefits for on-farm production and energy storage activities. In an Australian first, the CEFC and the National Farmers’ Federation collaborated to produce a practical guide for Australia’s 85,000 farming enterprises, identifying 51 opportunities where farmers can reduce their energy bills by improving energy efficiency and switching to renewables.

More information available at the LINK.

Building Upgrade Finance NSW

Building Upgrade Finance provides owners or managers of commercial buildings with access to finance to make a building upgrade.

To be eligible, you must:

- own an existing non-residential building located within a participating council- external site area, or have the approval to upgrade the building (the building owner must sign the loan contract)

- be upgrading a non-strata commercial building.

Typically, eligible projects fall into 3 categories:

- generation of renewable energy and emissions reduction (e.g. solar PV, end of trip facilities etc)

- improvement of energy and/or water efficiency (e.g. plant and equipment – lighting, air conditioning, boilers and lifts, rainwater tanks, water efficient fixtures and fittings)

- minimisation of waste (e.g. waste infrastructure systems).

Full information available at the LINK.

Queensland drought assistance

The new drought preparedness measures are open to all primary producers without needing a drought declaration. New measures include:

Drought Preparedness Grants

The Drought Preparedness Grant scheme will provide a rebate to primary producers of up to 25 percent up to $50,000 for on-farm capital improvements identified in their Farm Business Resilience Plan to improve the drought preparedness and resilience of their property such as drilling of a bore or installing feed storage. A drought declaration is not required for this grant.

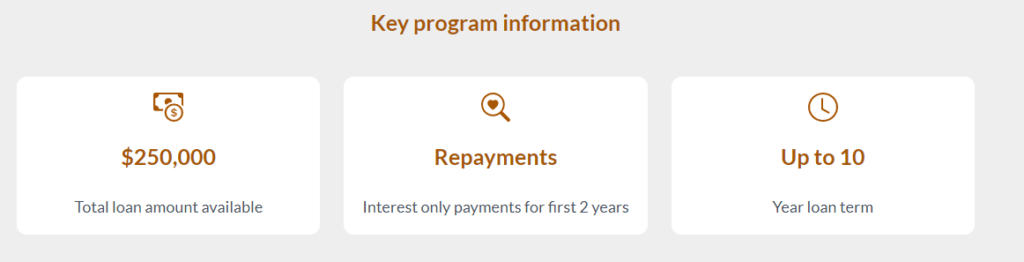

Drought Ready and Recovery Loan

The Drought Ready and Recovery Finance Loan provides a concessional interest loan of up to $250,000 for primary producers to undertake preparedness measures identified in their Farm Business Resilience Plan. Examples include drilling of a bore, installing water infrastructure, installing feed storage, expanding dams and improving irrigation. This is a complementary measure to the drought preparedness grants. A drought declaration is not required for this loan.

Emergency Drought Assistance Loans

The Emergency Drought Assistance Loan offers an interest free loan up to $50,000 to primary producers to assist in meeting working capital expenses. Applicants must be drought impacted.

Drought Carry-on Finance Loan Scheme

The Drought Carry-on Finance Loans Scheme provides a concessional interest loan to droughtdeclared primary producers of up to $250,000 for drought carry-on finance. These loans will be available where the $50,000 available from the Emergency Drought Assistance Loans Scheme is insufficient. Applicants must be drought impacted.

Collie Futures Small Grants Program

APPLY NOW for grants up to $100,000.

The Collie Futures Small Grants Program backs projects that support local economic growth and job opportunities.

Full information available at the LINK.

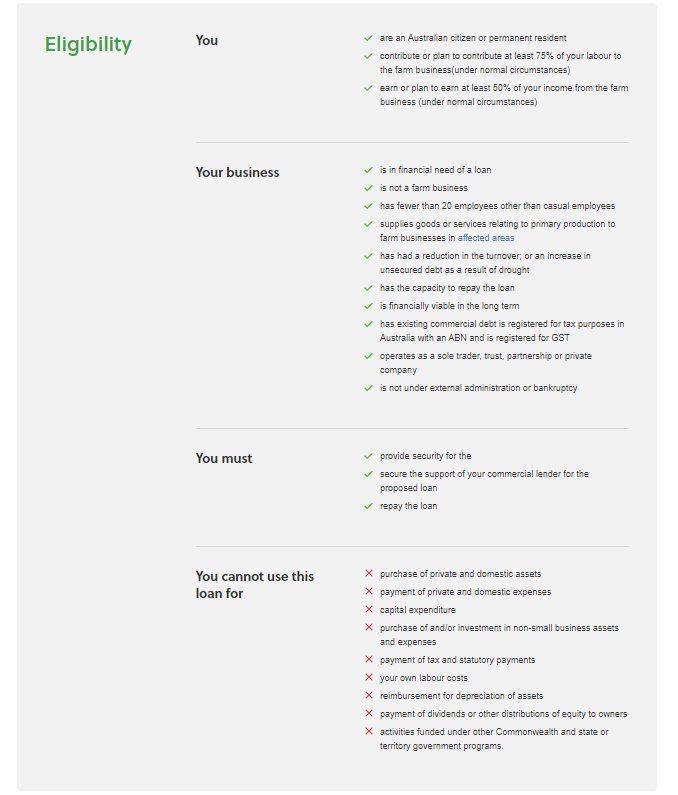

AgBiz Drought Loan

For farm-related small businesses to manage and recover from drought.

Submissions close at midnight 30 June 2023 (AWST).

Concessional loans for small, fast growing NT businesses

Business Investment Concessional Loans provide businesses in the Northern Territory with concessional loans to help them undertake projects which will expand and grow their business.

Projects must be of net economic benefit to the NT and should:

– create and sustain new local jobs

– increase economic activity

– expand production capacity

– grow export capability/import substitutability

Loans may be offered to small, emerging and fast growing businesses that:

– are able to demonstrate significant long term growth potential

– need to bridge the gap between feasibility and the ability to attract ongoing commercial debt funding

Loans are valued between $100 000 and $3 Million

ACT Farmers Support Package

The ACT Government Rural Resilience Grants support ACT rural landholders to translate knowledge into action. They are designed to support on-ground works that achieve improved farm and landscape resilience and prepare for drought and climate change.

The $5 billion Future Drought Fund is a long-term investment fund that provides a sustainable source of funding to help Australian farmers and communities become more prepared for, and resilient to, the impacts of drought. The Fund is part of the Australian Government’s Drought Response, Resilience and Preparedness Plan.

Agribusiness finance by Westpac New Zealand

Westpac is offering finance for a variety of agribusiness needs including:

- Buying a farm

- Buying new equipment

- Developing your farm

- Buying livestock

- Purchasing dairy company shares

- Covering cash short-falls

- Minimizing the impact of seasonal fluctuations

- Longer-term finance with fixed, fixed-forward, or floating interest rates.

Free up your working capital by purchasing shed with their equipment and infrastructure financing.

More information available at the LINK or you can CONTACT an agribusiness manager.

BNZ’s agribusiness support

BNZ is focused on helping farmers achieve long term financial and environmental sustainability. They invest and lend for the long term and are committed to backing agribusinesses that demonstrate strong financial and environmental management disciplines.

You can apply for up to 100% funding for new or used equipment for your business and customize your repayments and term of your loan to meet your cashflow needs.

Find more at the LINK.

Agri-banking by Rabobank

We back you with products tailor-made for farmers, and we put 100% of our deposits into New Zealand agribusinesses.

More information available at the LINK.

Rural Sustainability Loan (ASB)

Wherever you are on your journey to sustainable farming, ASB’s Rural sustainability Loan can help bring your environmental goals to life.

Asset Finance

This loan lets you buy, replace or refinance assets, while providing them as security for the loan. It can be an option to free up capital and take advantage of new opportunities.

Asset Finance Term loan

- Loan terms that match the economic life of your assets.

- Fixed and variable interest rate options.

- Flexible payment structures.

- Loan amounts starting from $20,000.

- Use new or existing assets as loan security.

- No deposit option.

More information available at the LINK 1 and LINK 2.

Government’s School Investment Package Supports 4,500 Projects

Budget 2022 provides continued investment in school infrastructure, totalling $777 million in capital investment. This builds on the $2.9 billion provided through successive Budgets, since 2018.

$24.3 million ongoing annual capital funding provided directly to schools for replacing furniture and equipment.

This funding adjusts the Funding and Equipment rate so that schools can properly maintain and upgrade their furniture and equipment. Funding will be provided directly to schools as part of the 5YA property process.

More information at the LINK.

Agribusiness innovation by AGMARDT

Agmardt was established by the Government in 1987 with funds of $32 million. Since then, they have provided more than $90m of funding through more than 1700 grants.

For more than 32 years, AGMARDT has been funding individuals and businesses to innovate, lead, and exploit opportunities, so New Zealand’s diverse agricultural sectors continue to grow.

AGMARDT provides funding for businesses and industry groups to develop and evaluate innovative ideas to a stage where they can attract other funding for further development through to commercialisation.

Agribusiness Innovation Grants are available in the following two categories:

AIGs project cost less than $30k

Seed funding grants for projects with total cost up to $30,000 (incl.GST) are available to applicants, without co-funding, for activities such as validation, prototyping, demonstration or investigation purposes.\

AIGs project cost greater than $30k

Grants of up to $200,000 are available for businesses, researchers and industry groups to develop and evaluate innovative ideas to a stage where they can attract other funding for further development through to commercialization.

Due to a large number of applications received and approved this financial year, AGMARDT has reached its 2022-2023 grants budget following the February 2023 funding round. Consequently, grants are now closed. Applications will re-open from November 8th. See below for future funding round dates.

Integrated farm planning work programme

Integrated farm planning is an approach that links these parts of your business together. Budget 2021 allocated $37 million over 4 years to expand tools and support to help you meet current and future market requirements and environmental regulations.

Using integrated farm planning will:

- make compliance more efficient by reducing duplication

- make it easier to meet regulatory requirements

- help identify opportunities and risks for future improvement

- assist you to achieve your business goals

- improve information sharing across the primary sector.

More information at the LINK.

Finance that’s farm fit by Heartland Bank

Heartland provides term finance to assist owning a successful farm which involves land purchase, farm development, capital stock and equipment purchases.

Terms up to 25 years

- Flexibility to change repayment terms seasonally

- Principal and interest, or interest only loans

- Fixed or variable interest rate options

- Interest calculated daily and debited monthly

- Negotiable balloon payments at term end

More information at the LINK.

Australian government (federal or state) support to farmers affected by the floods in Queensland and New South Wales

Disaster Assistance (Essential Working Capital) Loan

Disaster Assistance (Essential Working Capital) Loans are available to assist primary producers, small businesses, and non-profit organizations with essential working capital for expenses.

| Loan amount | Maximum of $100,000 |

| Loan term | Up to 10 years |

| Repayments | If needed, up to two years interest only may be available |

| Security | A loan under the scheme must be secured by a mortgage of land and other assets satisfactory to QRIDA. |

| Fees | No establishment fees, no account maintenance fees and no fees for early payout. |

Application close 31 December 2023.

Full information available at the LINK.

Rural Assistance Payments

Rural Assistance Payments can help farmers during or after an adverse event, eg. a flood or drought

As a result of the drought and floods in August 2021, the Government has activated Rural Assistance Payments from 2 August 2021 for Marlborough, Tasman, West Coat, Canterbury, Otago and the Chatham Islands.

To get this payment, any cash or off-farm assets you have must be under a certain amount. This doesn’t include farm or orchard assets, such as shares in dairy, meat or fertiliser companies.

| If you are: | Your assets must be less than: |

| single | $1,193.21 |

| a couple (with or without children) or a sole parent | $1,988.20 |

Rural Assistance Payments are generally paid in a lump sum covering 4 weeks. If you need the payment for longer than this, you’ll need to reapply every 4 weeks.

You can apply for Rural Assistance Payments for:

up to one year from the date you apply, or

a set length of time, which is approved by the Minister for Social Development.

You’ll get paid for whichever is the shortest of these options.

Full information available at the LINK

Disaster recovery small business grant – storms and floods August and September 2022 onwards

If you’re a small business or a not-for-profit organization in NSW and you’ve been directly impacted by storms and floods from 4 August 2022 or 14 September 2022 onwards, you may be eligible for a storm and flood disaster recovery small business grant.

This disaster recovery grant of up to $50,000 is to help pay for the costs of clean-up and reinstatement of a small business or not-for-profit organization’s operations.

If you received the full grant amount of $50,000 in June and July under AGRN 1025 and are now applying for funds under AGRN 1030 or 1034, you will be unable to complete this online application.

Applications close on 15 December 2023.

For more information, visit the LINK.

Extraordinary Disaster Assistance Recovery Grants – Northern and Central Queensland Monsoon and Flooding

Grants of up to $75,000 are available for affected producers following the Northern and Central Queensland Monsoon and Flooding, 20 December 2022 – 30 April 2023 to hire or purchase equipment and materials, clean up, remove debris, replace fencing and other costs associated with the recovery process. Producers should take photographs of the direct damage to accompany their application/s.

Applicants need to show they are an eligible primary producer within the declared disaster area and demonstrate they have suffered direct impact from the disaster. Read below the guidelines for more information.

The maximum grant amount is $75,000.

Applications for the Extraordinary Disaster Assistance Recovery Grants have been extended to 29 December 2023.

Funding for small businesses and not-for-profits affected by the River Murray Floods

This program provides funding to help eligible small businesses and not-for-profit organisations trade through the River Murray flooding emergency.

If your business usually operates in the affected area and has experienced a downturn of 30% or more in revenue within the last 3 months, you could be eligible for a $10,000 grant which could help you:

- pay for your usual business costs such as utilities, rent and staff salaries

- seek financial advice to support your business’ recovery

- make changes to your business, so it can operate effectively after the floods

- develop your business and extend reach through marketing and communications

- improve your resilience and future-proof your business for any future challenges

- retain your staff, stay connected and support your existing workforce.

Closing date: Application is extended to Sunday 31 December 2023

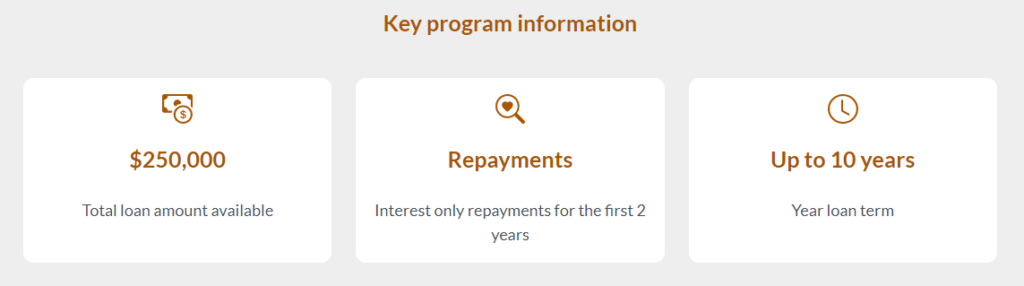

23 March 2023 Hailstorm Support

Growers and farmers in the City of Greater Shepparton and Yarra Ranges Council local government areas, whose properties who were impacted or suffered a significant loss of income as a direct result of the March 2023 hailstorm event, can apply for a Hailstorm Primary Producer Concessional Loan.

Loans of up to $250,000 are available to eligible growers and farmers, to restore or replace damaged assets and meet general expenses incurred while the clean-up is underway.

Applications close at 4 pm on the 14 November 2023.

6 October 2023 floods by Agriculture Victoria

Agriculture Victoria is available to help farmers in flood-affected areas to address urgent animal welfare concerns.

Farmers who have been impacted by floods and have urgent animal welfare needs, please contact the VicEmergency Hotline on 1800 226 226.

Please report any agricultural losses via our online form or contact the Agriculture Recovery team on 0427 694 185 (Monday to Friday between 8:30 am and 5pm) or at [email protected]

Impact assessment form Link

On-farm Emergency Water Infrastructure Rebate Scheme

The scheme has helped Australian farm businesses to build resilience and cope with the impacts of climate change.

The scheme provides rebates to farm businesses to purchase and install critical on-farm water infrastructure.

If eligible, primary producers or horticulture farmers can claim up to 25% of the cost of approved critical infrastructure, up to a maximum total rebate of $25,000.

Following the 2022-23 October Budget, the scheme will now close on 30 June 2024 or when funding is fully allocated.