A Look at the Farm Machinery Shortage in Australia

You only need to look at the used machinery market to see how significant the farm machinery shortage in Australia is. In 2021, a lightly used 2009 John Deere tractor sold at auction for $143.000. The same machine only cost $109,000 when purchased new.

High prices like this are a sure sign that demand for machinery has been well surpassing supply for many months now. This situation continues as there remains a scarcity of farm machinery in Australia that has been caused by a combination of factors.

Why is farm machinery scarce in Australia?

Back in early 2021 a bumper season for grain producers combined with strong grain prices, a tax-write off from the Australian government, and low interest rates to create the highest level of demand on the farm machinery market for over 40 years.

Farmers were keen to access cheap finance and utilise their tax deduction incentives to acquire the innovative machinery they wanted for their business.

This demand put pressure on farm machinery dealers and many yards quickly emptied.

At the same time, there was a shortage of components which interfered with the production of many items of machinery. This shortage was due to disruptions in the supply chain caused by COVID-19 restrictions.

These disruptions included:

- Manufacturing industry closures

- Shortage of labour caused by workforce restrictions

- Scarcity of raw materials due to COVID-19 border and transportation controls

High demand and supply interruption combined to bring about significant machinery shortages.

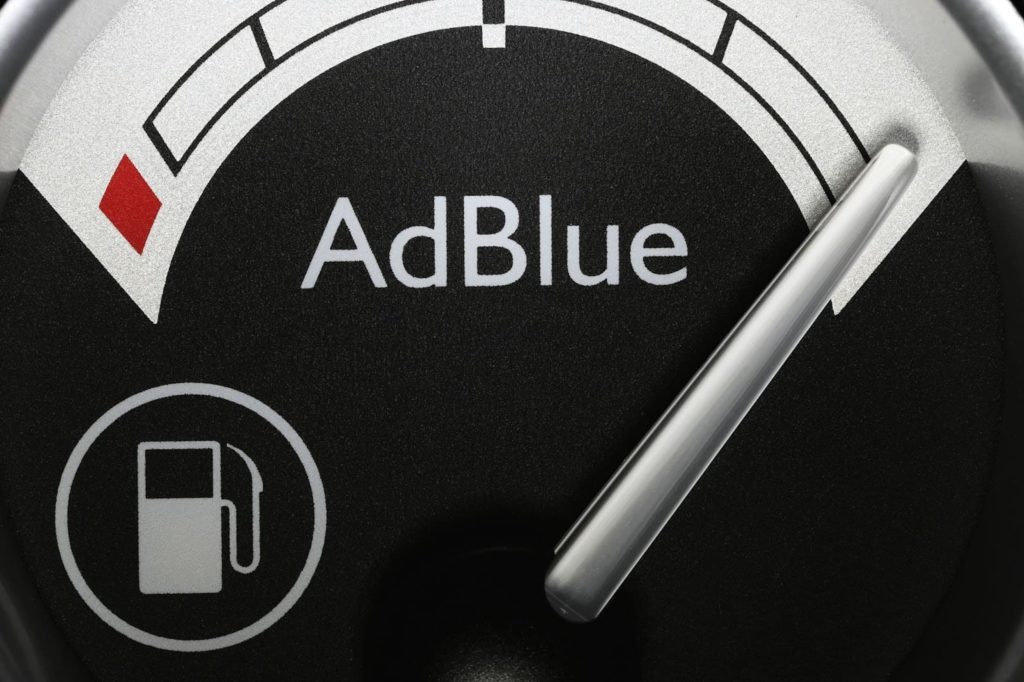

Issues regarding the availability of AdBlue have also contributed to the shortage.

AdBlue shortage added to the problems

AdBlue is a brand of urea-based diesel exhaust fluid (DEF). It’s an anti-pollutant used in modern diesel engines. Approximately one-third of this product comes from urea which is also a component of most fertilisers. There is currently a global shortage of urea.

China produces around 10% of the global supply of urea and provides around 80% of Australia’s supply. China also uses urea for its own agricultural production and has been experiencing fertiliser shortages over the last few months, along with the rest of the world.

At the same time, China has been experiencing increased demand for wheat, corn, and soy. As a result, more fertiliser, and therefore urea, has been used which has pushed up prices. In order to control these prices China stopped exporting urea to Australia.

This has had a detrimental impact on supply chains in the country which has further harmed the supply of machinery. An added impact on the agricultural industry is that much of the machinery used in farming is powered by diesel engines. This means that machinery which is already in place may be forced to lie inactive if there is insufficient AdBlue available.

While COVID-19 restrictions are now easing, the Australian farm machinery shortage is yet to end. It will take some time for the supply chain to recover and the issues around the supply of AdBlue remain. It’s also important to note that predictions are for another bumper grain harvest in Australia. This will put further pressure on a market with insufficient supply. Overall, the farm machinery shortage is not expected to ease significantly until at least 2023.